The research project “Success Factors in Residential Real Estate” was conducted in close cooperation between Habit-Unternehmensberatung, represented by Rolf-Dieter Perschke (1951 - 2012), and the Berlin School of Economics and Law, represented by Professor Dr. Fritz Schmoll genannt Eisenwerth.

Scientific basis

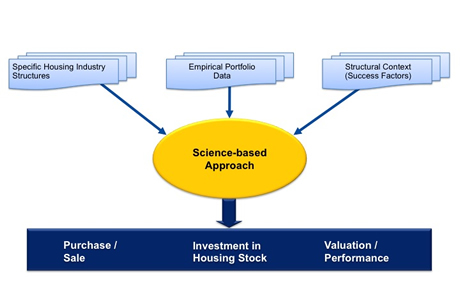

The focus of this long-term project was set on a comprehensive structural comparison of 30 housing companies and resulted in distinct, reliable, and scientific-based factors. They are the foundation of our analysing model.The results of the study provided new and surprising insights into the factors that really determine success in the housing industry. With the help of these tools, actual economic potentials and risks of real estate assets can be identified precisely and reliably.

By means of our model for strategic portfolio segmentation, both major property characteristics and long-term trends in supply and demand can be balanced providing definite proposals for future investments.

Hence we can tell:

- where the biggest economic potentials are hidden within your property portfolio

- which kind of capital expenditure will guarantee the maximum return on capital

- how you can improve cash flow in order to enhance your scope of action sustainably

- whether or not buying or selling a certain property at a given price makes sense from a commercial point of view

What to expect in 2013-2014

The research project was started in 2006 and has helped both the participating housing companies as well as the project initiators to achieve a much better understanding of the housing industry structures. These findings relate to the corporate strategy, the economic potentials, market activities, and the effects of competition and management. Continuous benchmarking makes long-term structural changes visible and clear options for actions for the particular company are shown.As of now, the project will be continued in 2013 and 2014. Currently, the sub-project "Successful marketing for housing companies" is being prepared and will be carried out in January-April 2014. The responsibility for the project lies in the hands of PORT|AS Portfolio & Asset Management, represented by Lutz Dessau.

Professor Dr. Fritz Schmoll genannt Eisenwerth, Professor Dr. Jeannette Raethel, University of Economics and Law, Berlin, and Tim Hoheisel as former employee at Habit Unternehmensberatung will act as academic advisors.

So far, about 30 housing companies in Berlin, Brandenburg, Saxony-Anhalt, Saxony and Mecklenburg-West Pomerania have participated in the project. They represent a total of 230,000 housing units, with a market value of more than 6 billion Euros. The findings resulting from this project have already passed their practical test as an integral part of several portfolio development plans.